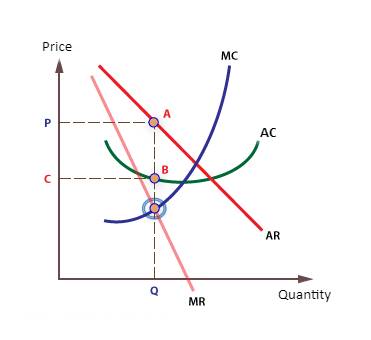

1) Profit maximisation: occurs where marginal cost equals marginal revenue → (MC = MR)

This means selling a good/service at a price where total revenue is at its greatest above total cost → (TR > TC)

It can be seen in the following graph with profits being maximised at Q, with the area of supernormal profits being PABC.

Advantages of profit maximising:

Advantages of profit maximising:

This means selling a good/service at a price which achieves the greatest sales revenue, and for each additional unit sold no extra revenue is generated.

It can be seen in the following graph, with revenue being maximised at A on the AR curve.

Advantages of revenue maximising:

Advantages of revenue maximising:

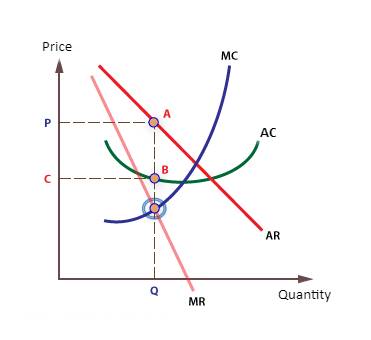

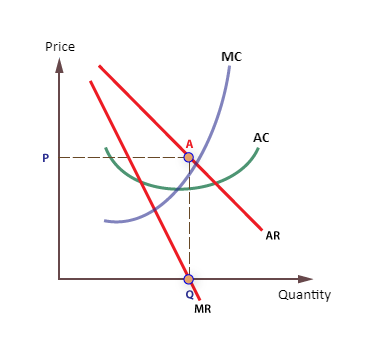

3) Sales maximisation: occurs where average costs equals average revenue → (AC = AR)

This means selling as many units of a good/service as possible, without making a loss. Firms choose to sacrifice some short-term profit with a view to achieving a longer-term gain.

This can be seen in the following graph, with sales being maximised at B where AC = AR.

4) Satisficing: occurs when a firm is

earning just enough profit to keep its shareholders content and for investors to maintain confidence in the management they appoint. When there is a divorce of ownership and control, the principal-agent problem may occur where there are different business objectives.

4) Satisficing: occurs when a firm is

earning just enough profit to keep its shareholders content and for investors to maintain confidence in the management they appoint. When there is a divorce of ownership and control, the principal-agent problem may occur where there are different business objectives.

This means selling a good/service at a price where total revenue is at its greatest above total cost → (TR > TC)

It can be seen in the following graph with profits being maximised at Q, with the area of supernormal profits being PABC.

- It satisfies the interests of shareholders and provides higher dividends for shareholders

- Profits can be used to pay higher wages to owners and workers.

- Higher profit levels may lead to increased capital spending which will benefit firms as they reinvest profits into improving and innovating goods/services which ends up benefitting the consumer.

- It enables the firm to build up savings, which could help the firm survive an economic downturn, as banks will be more willing to lend if the firm has a reasonable level of savings and history of profitability.

Disadvantages of profit maximising:

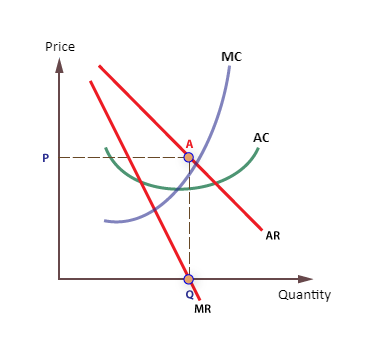

2) Revenue maximisation: occurs where marginal revenue equals 0 → (MR = 0)- Higher prices for consumers will reduce their real incomes/purchasing power and means a lower level of consumer surplus

- High profits might act as an incentive for new firms to enter the market – depending on how contestable it is – which in the longer term might reduce the returns to shareholders as competition intensifies

- Companies that become overly focused on maximising profits might lose sight of the social/ethical/environmental aspects of businesses to the detriment of local communities.

This means selling a good/service at a price which achieves the greatest sales revenue, and for each additional unit sold no extra revenue is generated.

It can be seen in the following graph, with revenue being maximised at A on the AR curve.

- It increases brand loyalty as lower prices attract more customers and will lead to greater exposure. This enables the firm to be more prominent in the market.

- Other competitors can be competed out of business and this enables the firm to have more market share and profit in the long term.

- Lower prices for consumers will increase their real incomes/purchasing power and means a higher level of consumer surplus

- Lower prices and higher sales can help firms with high fixed costs gain economies of scale (lower average costs).

Disadvantages of revenue maximising:

This means selling as many units of a good/service as possible, without making a loss. Firms choose to sacrifice some short-term profit with a view to achieving a longer-term gain.

This can be seen in the following graph, with sales being maximised at B where AC = AR.

- Owners want to profit maximise.

- Shareholders want to profit maximise since they earn larger dividends from them.

- Managers have less incentive to profit maximise since they do not receive the same rewards, therefore managers may create a minimum level of profit to keep the shareholders happy, whilst still meeting their other objectives.

Post Comment

Post a Comment